+ Recent years have seen a dramatic decline in foreign investment in the UK. Foreign investors no longer find Britain as attractive as it used to be due to an increase in energy costs, recent political turmoil, and Brexit.

+ 2022 data shows significant falls in investment in the two biggest investment drivers for the UK–digital technology and business services. As a result, Canada, large parts of northern Europe, and the United States are becoming more attractive investment destinations.

+ A negotiated and adopted UK-EU agreement might make the UK more attractive to foreign investors. However, neither Labour nor the Conservatives are likely to agree to new arrangements with the EU due to their fears of losing the Brexit voters.

Weathering Energy Shocks and Political Upheavals

With a remarkable net inward value of £2 trillion in Foreign Direct Investment (FDI) in 2021, the UK ranks behind only the United States and China on the world stage. However, foreign investment in the UK has changed dramatically over the last few years. A rise in energy costs, recent political turmoil, and Brexit have made Britain less competitive and less attractive to foreign investors. Therefore, investors considering investing in the UK should proceed with caution. In particular, this is crucial for US investors, as the U.S. is the largest source of direct investment into the UK, with thousands of companies operating there.

Indeed, a 2023 survey by the Global Infrastructure Investor Association (GIIA) indicates that infrastructure investors are becoming increasingly less inclined to fund projects in the UK. GIIA's 'Pulse' survey revealed that investors were more concerned about raising funds and debt than at any time during the study's three-year history. In addition, data from 2022 indicates significant falls in investment in the UK’s two biggest investment drivers–digital technology (down 23.3% from 305 projects in 2021) and business services (down 25.5%). In contrast, Canada, large parts of northern Europe, and the US are emerging as more desirable investment destinations.

A better understanding of the risks associated with investing in the UK can assist in evaluating the decision. One key concern is rising energy costs. The UK announced in January 2023 that it would cut energy subsidies for businesses by about 85% to 5.5 billion pounds ($6.7 billion) for the next financial year, challenging the financial stability of companies. According to the 2023 Make UK/PwC Senior Executive survey, the majority of companies in the UK (70%) anticipate increasing energy costs in 2023, with two-thirds thus considering reducing production or cutting jobs. Additionally, 64.3% of companies say increased energy costs are their biggest risk, while over two-thirds (68.9%) say uncertainty around energy costs is their biggest worry.

UK politics has also had an inescapable impact on business risk. The domestic political upheaval of the past few years has reduced the UK's competitiveness as a manufacturing location, making it less attractive to foreign investors. A 2022 survey of 235 businesses found 53% of firms said that ongoing political instability had affected business confidence. The past year has been one of the most turbulent years in modern British politics. The country has gone through three prime ministers and is currently suffering from a cost-of-living crisis that threatens to alter voters' political preferences. Thus, the current political instability is proving harmful to resurgent economic growth in the wake of the Covid pandemic, and may also lead to more frequent policy changes, contributing to further volatility.

As part of the politics equation, Brexit is also an important factor. As a result of leaving the EU's Single Market and Customs Union, the economic relationship with the EU was profoundly changed. Trade and labor supply have been disrupted by new border controls and immigration restrictions, both of which are likely to weigh on the UK’s long-term growth. Due to these factors, the UK economy remains the only advanced economy in the G7—a group that includes Canada, France, Germany, Italy, Japan, and the United States—with a smaller economy than before the pandemic. Imports have become more expensive, while exports have stagnated despite post-pandemic trade booms elsewhere. In the long run, exports and imports are projected to be around 15% lower than before Brexit.

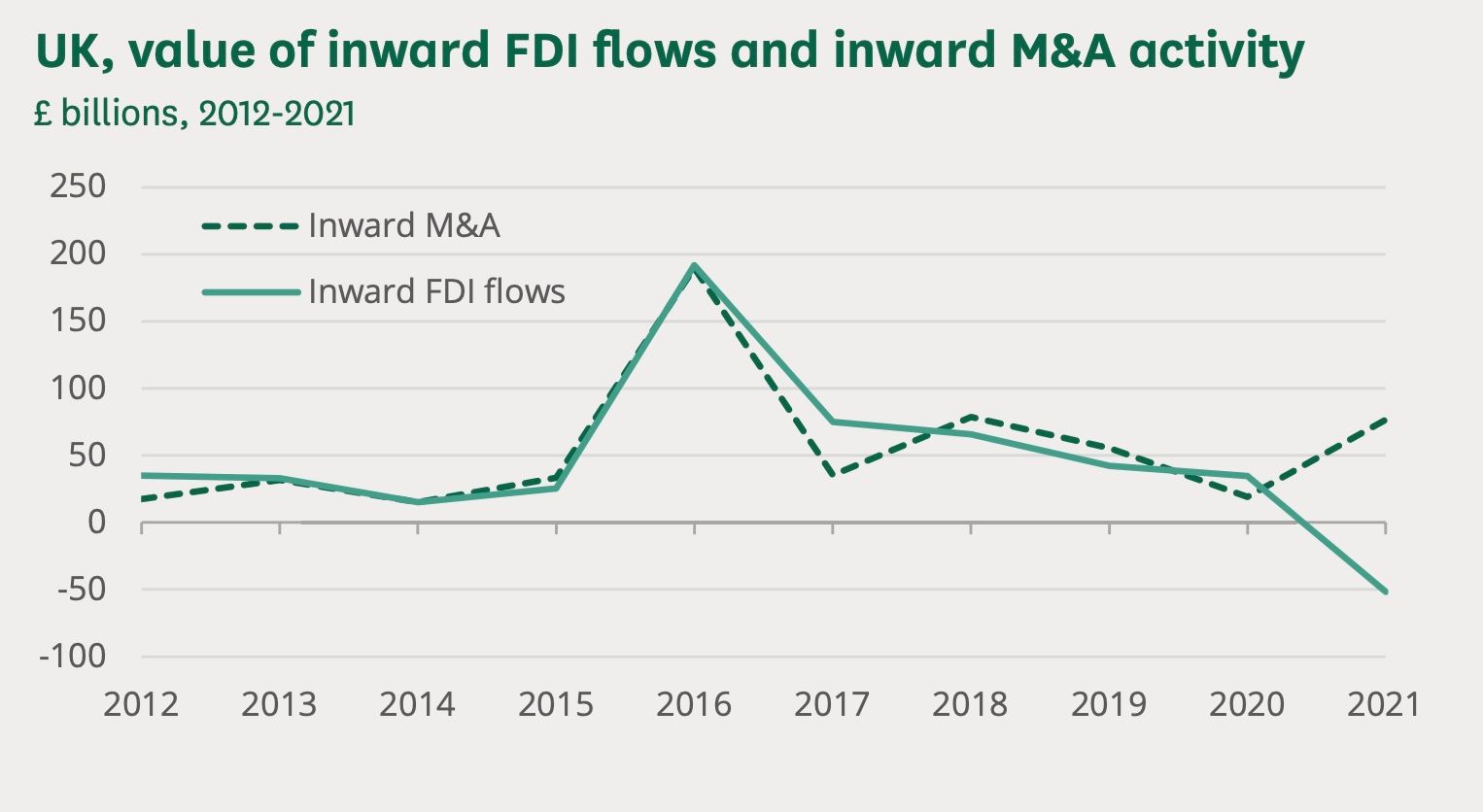

Without doubt, the aftermath of Brexit has broadly weakened the UK investment environment, which has reduced the size of the economy and future growth. Since the referendum in June 2016, business investment has fallen sharply. FDI inflows were negative in 2021, which means foreign firms pulled more investment out of the UK than they put in. While inflows rebounded in 2022, they were only a fifth of what they were in the three years prior to the pandemic.

EU Ties, Political Calculations, and Economic Implications

Nevertheless, a negotiated and adopted UK-EU agreement might increase the UK's attractiveness to foreign investment. In September, Keir Starmer, Labour's leader, and contender for Britain's next prime minister, visited Paris for talks with Emmanuel Macron. A proposed plan for a four-tiered European structure, backed by France and Germany, would grant the UK access to the single market again. At the very least, this access would come at the cost of an annual contribution to the EU's budget and an agreement for dispute resolution under the purview of the European Court of Justice. Despite this, it was unclear how Starmer would respond to a proposal that at first glance appears very similar to Norway's current EU deal. This allows access to the single market, but also means a commitment to the free movement of persons into the UK, complete with all the political baggage that would entail.

This, in turn, is likely to draw down consumer spending, amplifying the post-Brexit disruption in the labor market which could otherwise unlock badly needed tax revenue.

As a result, Starmer has already ruled out a return to the single market—believing that accepting it before a general election would open the floodgates for immigration. In addition, Labour would have a tough time winning over Leave voters with such a proposal. Given the pro-Brexit stance of the Conservative party, and assuming no about-face from Starmer’s Labour going into the next general election, evidence indicates that an associate deal with the EU, as described above, is not in the cards. This means that the UK is unlikely to rejoin the single market, or offer visa-free work rights to EU citizens.

In October, the Office for National Statistics (ONS) announced that there was a faster recovery than expected from the Covid pandemic in the UK. However, indicators also point to the pound's worst month against the US dollar in a year, falling almost five cents, or 3.8%. In addition, as a result of the UK government's energy price cap scheme, households could face energy bills of almost £1,900 a year during the coldest months of the year. This, in turn, is likely to draw down consumer spending, amplifying the post-Brexit disruption in the labor market which could otherwise unlock badly needed tax revenue. The cumulative effect is a negative trend in the investment environment in the UK, and as such, at least for the next few years, investors may continue to search for alternative markets.